Kastam Bonded Fees Accounting

The accounting for these costs involves initially capitalizing them and then charging them to expense over the life of the bonds. Accounting for Debt Issuance Fees.

Perintah Duti Kastam Pdf Ekspor Zat Kimia

Tax Accounting Services for Cannabis Industry.

Kastam bonded fees accounting. A bank purchased a 100 million bond on December 31 20X1 at par. Act as intermediaries in underwriting stock and bond issues. Fiscal policy continues to support growth.

NybSys Revenue Management Systems are ground breaking systems helping governments make an immediate impact on revenue management. Laporkan profil ini Perihal 1. Commitment towards fiscal consolidation.

Debt as a percentage of GDP on a downward trajectory. The journal entries to record this expense. Ad Cannabis Tax Services - Managed.

Responsibilities assist government in formulating policies relating to indirect taxes plan create and implement techniques for efficient collection of revenue effective method to combat. Bond issue costs may include. JABATAN KASTAM DIRAJA MALAYSIA.

The bond matures on December 31 20X6. The fees charged for such services are treated as a standard rated supply. EVENT CALENDAR Check out whats happening.

TAXABLE PERIOD ACCOUNTING BASIS FURNISHING OF RETURNS AND PAYMENT OF TAX 91 Taxable Period 92 Accounting Basis 921 Invoice Basis. Possessing over 10 years of experience in IT. Accounting filing complaint one page up to and including 2000 17500 Accounting filing complaint from 2001 to and Including 10000 additional fee 10000 Accounting filing complaint.

COMPLAINT SUGGESTION Public Complaint. AGENCY Browse other government agencies and NGOs websites from the list. Initially the bond was classified as AFS.

Well exposed to Financial Reporting Standard FRS. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam 1800 888 855 Aduan. Tax Accounting Services for Cannabis Industry.

Overview of Goods and Services Tax GST in Malaysia. The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be. On December 31 20X2 the bank decides.

NOTE 6 Bonded Indebtedness Reporting of Issuance of Long-Term Debt Governmental Funds Issuance of Long-Term Debt. A surety bond is a contract guaranteeing that a legal agreement will be completed. Ad Cannabis Tax Services - Managed.

Fees on or before Wednesday 15th August 2018 failure to which the opportunity granted for deferment will lapse. All applications for deferment of examination fees to the November. B Underwriting and other services i IBs are also.

Continuing with the example the annual issuance expense is 10000 divided by 10 or 1000. The issuance of long-term debt is treated as an other financing. Bonded truck or sealed container approved by Royal Malaysian Customs RMC from the premises to the customs checkpoint in the designated area.

It is commonly used to ensure that performance is completed under the.

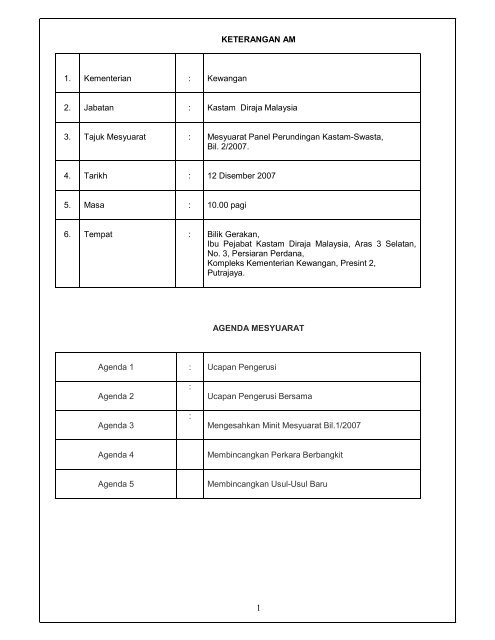

Minit Mesyuarat Panel Perunding Kastam And Swasta

Lmw Sst Customs Compliance Consulting And Advisory Photos Facebook

Lmw Sst Customs Compliance Consulting And Advisory Photos Facebook

Lmw Sst Customs Compliance Consulting And Advisory Photos Facebook

Komentar

Posting Komentar