Different Of Service Tax And Service Charge In Kastam

This charge accumulates to the establishment imposing the charges and is pooled into a fund to be paid to workers in the industry. Taxable person is any person who belongs in Malaysia and is prescribed to be a taxable person.

Malaysia Sst Sales And Service Tax A Complete Guide

Service Tax registered person should be able to include the imported taxable services in the SST -02 return.

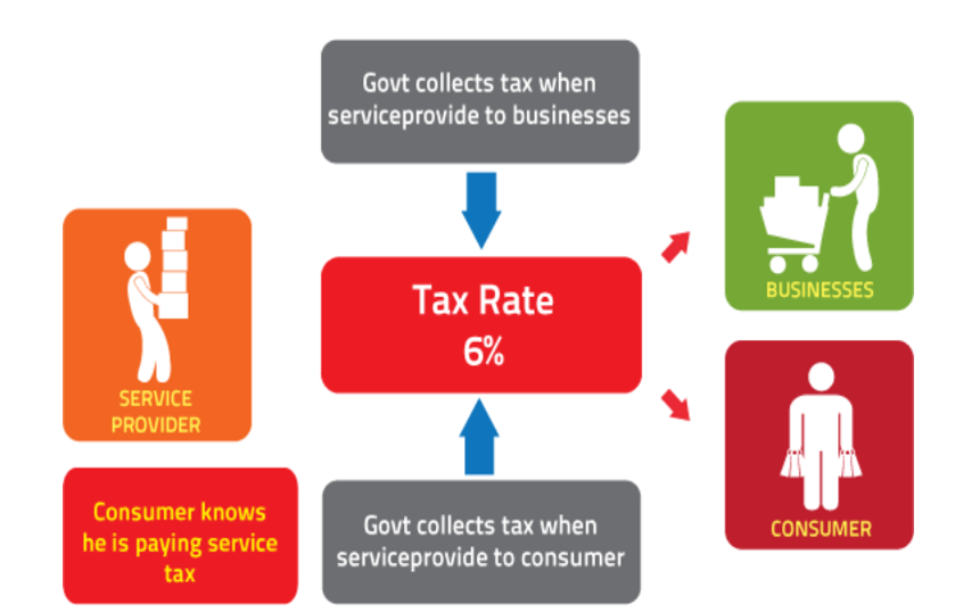

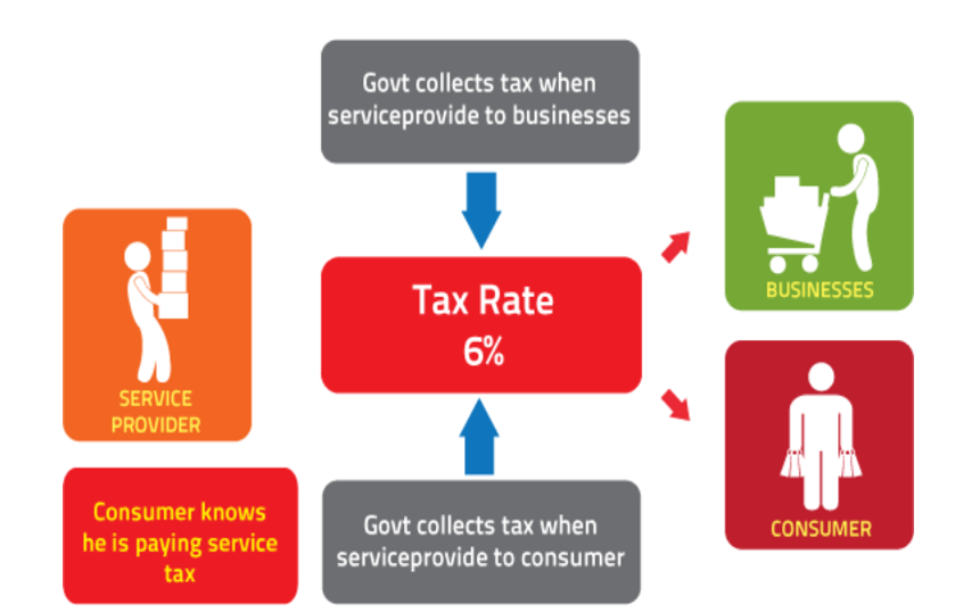

Different of service tax and service charge in kastam. The current rate of service tax is 6. 9 PARTICULARS OF MANIFEST Vessel IDName Voyage Number SCN Shipping Agent BL Number Description of cargo Total packages Weights POLPOD. The rate of service tax.

The SST has two elements. Ad Cannabis Tax Services - Managed. Sales and Services Tax SST in Malaysia.

The SST is a single stage of consumption tax while GST is a multi-stage of consumption tax on goods and services that were levied at every stage of the supply chain. The effective date of the Service Tax Act 2018 is 1st September 2018. The Service tax is also a single-stage tax with a rate of 6.

You are required to charge service tax for the services of operating the hotel and service apartment. A service tax that is charged and levied on taxable services provided by any taxable person in Malaysia in the course and furtherance of business and a single stage sales tax. Non- Service Tax registered person or Sales Tax registered manufacturer who is not registered for Service Tax.

This page is also available in. Service tax only can be charged and levied on any services under the First Schedule of the Service Tax Regulations 2018. Service tax that is a tax charged and levied on taxable services provided by any taxable person in Malaysia in the course and furtherance of business.

Service Tax is a consumption tax governed by the Service Tax Act 2018 and its subsidiary legislation. Service charges can be a replacement for tipping charge though not necessarily so. In the service tax.

Tax Accounting Services for Cannabis Industry. The SST replaces the existing Goods and Services Tax GST and affects all domestic and import shipments. Differences between service tax and service charge.

Taxable service is any service which prescribed to be a taxable service. In the promotion of the new membership recruitment campaign the hotel offers. Ad Cannabis Tax Services - Managed.

Service Tax No3 Service Tax Return CUSTOMS COMPOSITE FORMS. Taxable services are prescribed in broad categories on a positive list. Service Tax is a consumption tax governed by the Service Tax Act 2018 the Act and its subsidiary legislation.

With effective from 1 January 2019 imported taxable service is subjected to service taxIn accordance with Section 2 of Service Tax Act 2018 imported taxable service means any taxable service. There are no input or exemption mechanisms available for service tax. The rate of service tax is fixed under the Service Tax Rate of Tax Order 2018 and comes into force on 1 September 2018.

Service tax is imposed on prescribed services called taxable services imported taxable service and digital service. Services specifically proposed to be subject to service tax. Registered person is a taxable service provider who is liable to be registered under Section 13 Service Tax Act 2018 with taxable service.

If a service is not specifically prescribed as a taxable service then it will not be within the scope of the service tax. This tax is not required for imported or exported services. 1 The service tax is a government levied tax and is fixed in every state of India at 14 percent.

Rate of Service Tax 9. Pay the dutyany charges. Tax Accounting Services for Cannabis Industry.

Melayu Malay 简体中文 Chinese Simplified Guide to Imported Services for Service Tax Guide on Imported Taxable Services. The Sales and Services Tax SST has been implemented in Malaysia. The effective date of the Act is 1st September 2018.

On the other hand service charge. Service tax is not chargeable for imported and exported services under the STA 2018. Proposed rate of service tax 6.

Service tax government tax is a legislated tax at rate 6 effective From January 2011 imposed under the Service Tax. Service Tax is charged on a specific service provided by a taxable person in Malaysia carrying out a business. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam 1800 888 855 Aduan.

Service tax is also a single-stage tax charged once by the service provider. The rates of SST.

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Komentar

Posting Komentar